2 Part Roof Depreciation

For 2018 he claimed a depreciation deduction of 311 using the 10 71 depreciation rate from the 150 declining balance half year convention table shown in table a 14 in appendix a of pub.

2 part roof depreciation. Some items may devalue more rapidly due to consumer preferences or technological advancements. Let s say your roof is supposed to last 20 years and it s 5 years old when damaged. The difference is depreciation. On july 2 2019 the cooperative association paid mr.

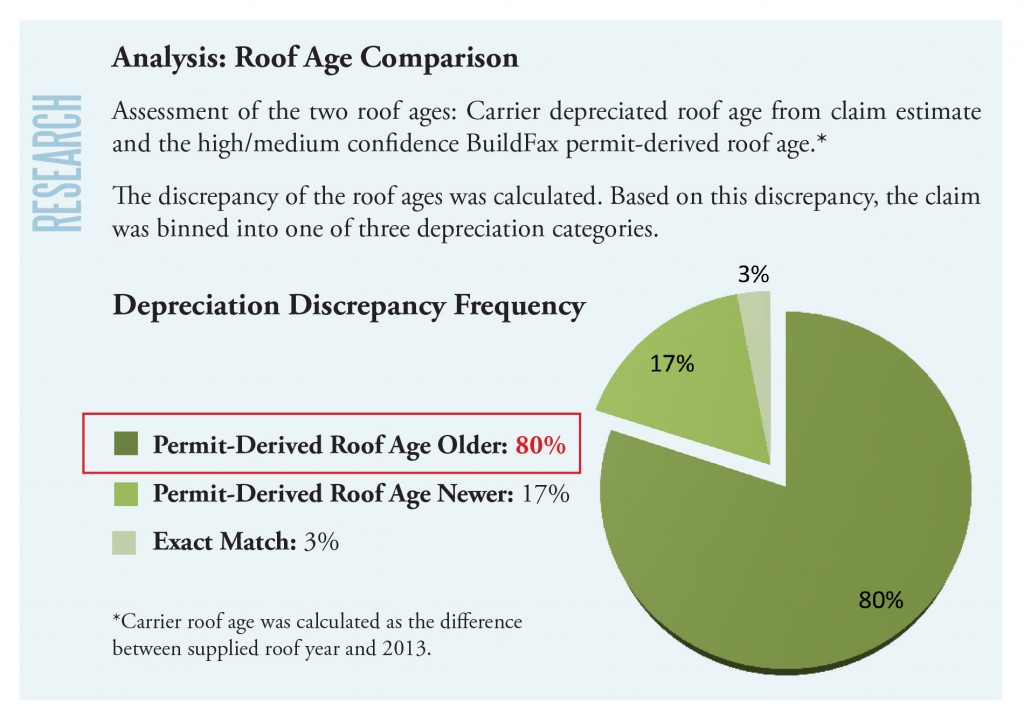

Why was the roof replaced. Calculating depreciation based on age is straightforward. The older the roof the more deducted for depreciation. Insurance valuation methods can be confusing and difficult to determine based on your individual needs and circumstances.

Learn how depreciation is calculated by insurance companies. If your home s roof is damaged by a storm you need to understand the part depreciation plays in the claim process. For example if you ve owned a rental property for 10 years before you installed a new roof you can depreciate the roof over 27 5 years even though you have 17 years of depreciation left on the property. Therefore the repainting costs are part of the capital improvements and should be capitalized and depreciated as the same class of property that was restored as discussed above.

As you can see in the above example doe will receive 14 000 from his insurance company whereas smith will receive only 4 000. Brown a 300 cash patronage dividend for buying the machine. The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings. A new roof is considered a capital improvement and therefore subject to its own depreciation.

There are many variables which can affect an item s life expectancy that should be taken into consideration when determining actual cash value. Questions to assess whether the roof work is a capitalized betterment under regs. The insurance adjuster depreciated the roof 50 an arbitrary number based on its age so the actual cash value of the roof is now 5 000. The irs uses the straight line method to calculate the depreciation of your roof which means that the depreciation of your roof is calculated evenly across a set period of time.

The age and condition of your roof will play a big part in the value of your hail damage claim. In this case the painting is incurred as part of the overall restoration of the building structure. Replacement of the furnace in your residential rental property. How is depreciation on a roof calculated.

Generally if it was due to sudden damage the cost to bring the roof back to the same condition using the same materials is not a betterment. The recoverable depreciation also happens to be 5 000 10 000 replacement value less 5 000 actual cash value.